UPI App Development Guide: Mastering Payment Solutions for 2024

26 April

Several nations have embraced the Unified Payments Interface (UPI) to unlock the potential of real-time transactions. UPI offers seamless experiences like purchasing Eiffel Tower tickets. For companies, venturing into UPI app development solutions proves to be a lucrative endeavor.

Anticipated to soar, the daily UPI transaction volume is projected to reach $1 billion by 2027. Consequently, there’s a surge in demand for UPI apps that are swift, secure, and offer enticing incentives. Swift action is imperative for businesses situated in nations either newly embracing UPI or planning to do so. Crafting a UPI app can provide a solid foothold in this burgeoning market.

In this UPI App Development Guide by Codeflash Infotech, delve into everything you need to know about UPI App Development. From step-by-step procedures to estimating development costs and must-have features, equip yourself with the knowledge necessary to successfully navigate the realm of UPI app development Guide.

What Is UPI App Development Guide and How Can Customers and Businesses Benefit From It?

Here’s how companies may reach a new client frontier with the help of a payment service app development company:

Advantages for Companies With Greater Reach

Through UPI, companies may connect with millions of people who are either banked or not, a demographic that is typically hard to contact with conventional means. On the other hand, from a different angle, it also makes it possible for these people to engage in the expanding cashless economy, increasing financial inclusion. Thus, integrating UPI into your financial ecosystem might assist you in reaching a wider audience and gaining traction in a dynamic and changing market.

- Enhanced Practicality

With only a few smartphone touches, your consumers may easily pay for your goods or services, thanks to UPI. This eliminates the requirement for cash and card data to be remembered. A quicker and easier payment process is made possible with UPI, which boosts consumer satisfaction and increases conversion rates. - Enhanced Safety

Gaining your clients’ confidence is essential, and UPI places a high priority on security. During transactions, effective mechanisms like encryption and multi-factor authentication (MFA) keep private information out of the wrong hands. This guarantees your clients and your company’s peace of mind. - Economy of Cost

Transaction costs for UPI transactions are cheaper than those for more conventional payment methods like credit cards. Businesses benefit from higher profit margins as a result, which enables them to spend on expansion and provide customers with competitive pricing.

Advantages for Clients

Not only can UPI help businesses, but it also provides a host of benefits to customers.

- Convenience:

UPI makes payments simple and quick, so there’s no need to carry currency or use less practical payment options. - Security:

To safeguard their financial information during transactions, it provides upgraded security measures. - Potential Incentives/Rewards:

Using UPI transactions gives customers many chances to get cashback or other incentives. In practice, this provides an additional layer of value.

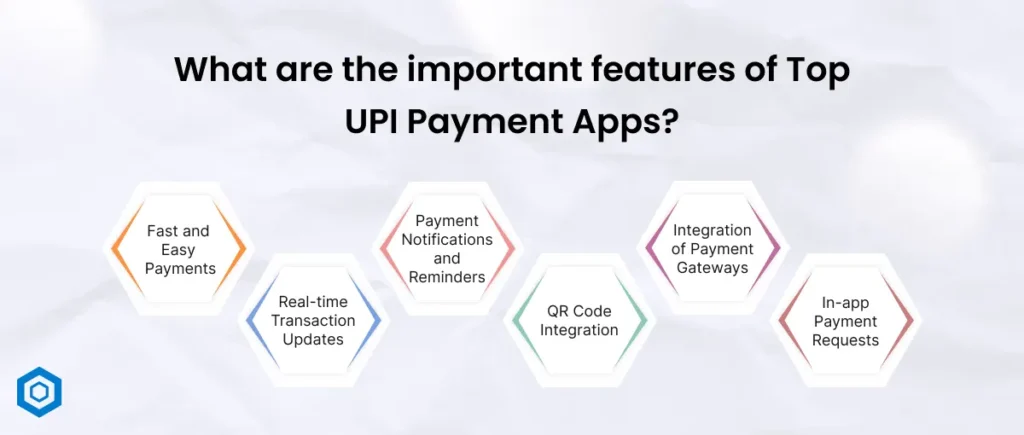

What are the important features of Top UPI Payment Apps?

Because UPI payment application development has so many features that work well with small business transactions, they help firms streamline financial operations.

Let’s examine some of the main characteristics of UPI payment applications that can

- Fast and Easy Payments: Businesses may send and receive money rapidly and hassle-free by using UPI payment applications.UPI enables faster transactions and streamlines manual processes, enhancing productivity. With multiple payment options like bank transfers, mobile wallets, and QR codes, businesses cater to customer preferences, ensuring convenience and smooth transactions.

- Real-time Transaction Updates: Using UPI payment applications, businesses may monitor their agreements in real- time. Additionally, it facilitates payment tracking and encourages openness, which lowers the possibility of mistakes.

- Payment Notifications and Reminders: In certain respects, UPI payment applications come with tools that let businesses and customers exchange reminders for payments. Because they can expect to get the money, this lowers the possibility that they won’t make the payment, allowing firms to stay organized.

- QR Code Integration: Businesses may come up with their individual UPI payment apps that allow users to initiate transactions by just scanning a UPI code. Additionally, it simplifies the tedious part of making payments by eliminating the need for you to enter each fee separately.

- Integration of Payment Gateways: Payment gateways integrated into mobile Businesses can accept payments from many sources through UPI payment apps. It helps companies to take advantage of the growing virtual market and reach out to more people for the goods and services they offer.

- In-app Payment Requests: These companies offer a variety of services, one of which is the ability to generate payment requests and send them straight to the customer’s wallet. Customers may easily commence payments with it, which simplifies their access and lessens the requirement to connect additional external communications.

How to Create a UPI App like Phonepay, Paytm or Google Pay?

Before engaging a mobile app developer for your project, do a few things.

- Establish the Project Scope

A UPI app development may have an infinite amount of features and functionalities added to it. Which of those do you intend to cultivate? A project scope helps the development business understand exactly what you want and establishes your particular needs. Make a detailed project scope document that outlines the features, functionality, target market, launch platforms, and app concept. - Make a Payment App monetization plan.

What precise revenue-generating strategy do you have in mind for your UPI app marketing? There exist several avenues for monetization

Promotions: Collaborate with companies to offer coupons and discounts on your app. User engagement and income growth both gain from this.Value-Added Services: You have the option to charge a convenience fee for extra services including subscriptions, bill payments, recharges, and reservation of tickets.

- White-labeling

You may grant licenses to other companies or platforms—such as social networking applications and e-commerce websites—that wish to accept UPI payments from their clientele. We advise against charging a transaction charge because most well-known UPI apps allow free payments. - Make Sure It’s Compliant

Prepare the required documentation and compliance for your application as the last stage. Since the rules about this vary by nation, we advise you to speak with a legal expert. Make that your app doesn’t break any laws about consumer rights, intellectual property rights, or anti-money laundering.

Speak with a UPI Mobile Application Development Firm

Codeflash Infotech can provide reliable and safe UPI application development services for your company. Having led the finance industry for many years, we have the know-how to implement your mobile app idea. From conception to post-launch maintenance, we can take care of everything to ensure your app functions flawlessly. To get started, submit your project scope document and complete the contact form. Together, let’s develop an innovative UPI

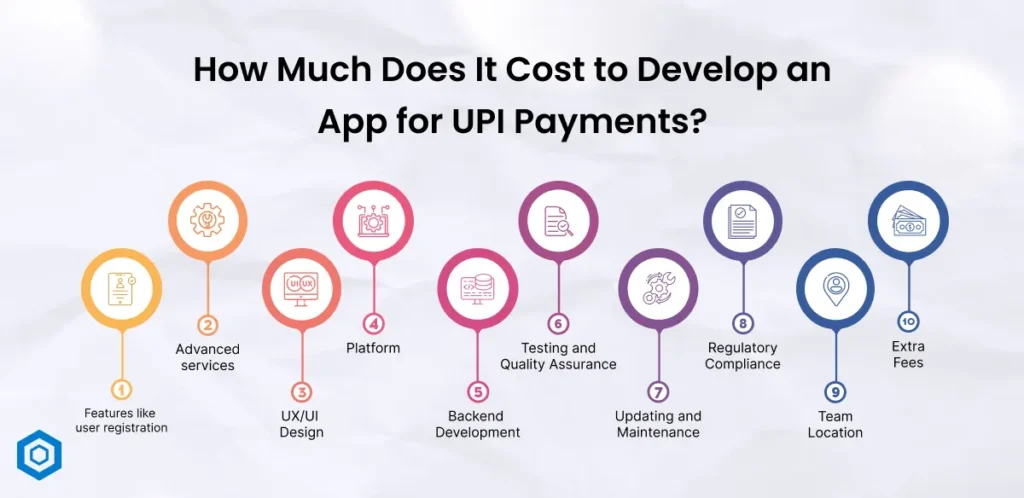

How Much Does It Cost to Develop an App for UPI Payments?

“What is the UPI payment app development cost? is now the key query. The true cost of developing a UPI payment app might be difficult to ascertain for various reasons.

However, depending on the specifics of your project, we can quote you a ballpark price that ranges from $25000 to $75000 or more. The variables significantly affecting how much it costs to design a mobile banking(wallet) app are listed below.

- Features: Basic features include user registration, bank account connection, payment initiating, transaction history viewing, and so on. They cost between $5,000 and $20,000.

- Advanced services: The pricing will increase for additional services like bill payment, split payment, QR code scanning, connection with other payment gateways, etc. Depending on how complicated it is, this might cost anywhere from $10,000 to $50,000 or more.

- UX/UI Design: The success of any app depends on having a visually appealing and user-friendly design. Depending on the degree of intricacy and customization, design fees range from $5,000 to $20,000.

- Platform: The expense of producing for both the iOS and Android platforms will inevitably be higher than building for just one. Developing two platforms at the same time usually costs between 25% and 50% more. However, this might vary depending on the platform.

- Backend Development: It’s crucial to have a strong backend infrastructure to manage transactions effectively and safely. Backend development might cost anywhere from $10,000 and $50,000, depending on the complexity and size of the project.

- Testing and Quality Assurance: Testing is essential to ensure the software runs safely and correctly. Usually, testing expenses account for 15% to 25% of the whole development budget.

- Updating and Maintenance: After the software is out, there will be continuous expenses for bug patches, security upgrades, and other updates. Although this cost is subject to change, it is often approximated as a percentage of the original development cost, with an annual range of 20% to 30%.

- Regulatory Compliance: Extra expenses could be required if the software needs to abide by particular laws or certifications, such as PCI DSS compliance for processing card data.

- Team Location: The geographical location of the app development team significantly impacts expenses. Dedicated developers based in pricier regions typically command higher rates than those in more affordable areas. To explore further insights on how much it costs to hire app developers, check out our blog for valuable information and tips.

- Extra Fees: Depending on the needs of the app, there might be additional fees for licenses, integrations, or third-party services.

Need a UPI payment app? Contact Codeflash Infotech for a quote. Let us know your needs and budget; we’ll give you the true cost.

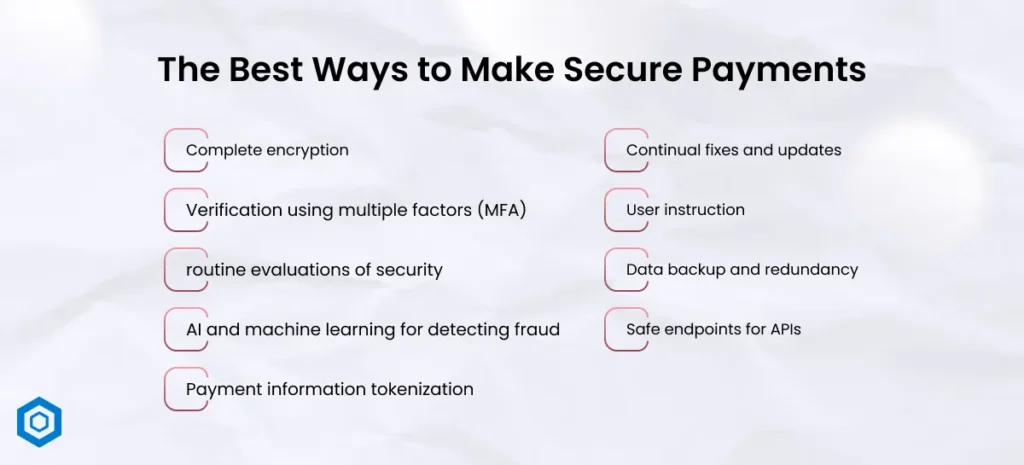

The Best Ways to Make Secure Payments

Safeguarding and maintaining the confidentiality of users’ financial information is crucial in the realm of payment applications. Businesses and developers need to create methods that keep up with the evolving hazards of cyberspace. These are the best practices to think about:

- Complete encryption

You may be sure that hackers or intermediaries cannot access or decode sensitive data by encrypting it at the source and only decrypting it at the destination. For strong security, it’s essential to use modern encryption protocols like AES (modern Encryption Standard). - Verification using multiple factors (MFA)

Unauthorized access can be prevented by adding more levels to the authentication procedure. Security questions, OTPs, and biometric verification—such as fingerprints or face recognition—can all be used to do this. - routine evaluations of security

Periodically review and evaluate the application. To find any possible vulnerabilities, think about hiring outside security professionals to perform comprehensive penetration testing. - AI and machine learning for detecting fraud

Include AI programs that keep an eye on transaction trends. These systems can recognize normal user behaviour and promptly identify and validate any transaction that seems abnormal. - Payment information tokenization

Use tokens in place of keeping sensitive data or real card information. These tokens are worthless in the event of a breach unless a certain system can decode them. - Continual fixes and updates

Regular upgrades are necessary to combat emerging threats and weaknesses. Make sure consumers understand how important it is to update their apps. - User instruction

Provide users with information. Share the best practices for staying secure, phishing schemes, and other security dangers with them. - Data backup and redundancy

By safely storing user data and putting mechanisms in place to guarantee constant availability, even during unplanned outages, you can preserve data integrity. - Safe endpoints for APIs

Your app’s APIs—the channels through which it communicates with servers and other services—must be protected from attacks such as DDoS and SQL injections. Put policies in place, such as rigorous authentication and rate limitation.

Conclusion

The UPI App Development Guide in 2024 highlights the value of outstanding user experience, strong security, and innovation. The discourse highlights a variety of features, development processes, and obstacles that make it clear that the digital payments space is dynamic and challenging.

Monetization methods demonstrate the industry’s profitable potential, and case studies emphasize that, even in the face of market saturation, creative solutions may create unique success stories. Due to consumers’ always-changing demands and the way technology is developing, payment applications are one of the industries that is always full of potential.

It’s critical for companies looking to leave their imprint to grasp these subtleties. The winning approach going ahead will be to make sure that payment applications are comprehensive experiences rather than merely transactional tools.

In Codeflash Infotech, we’re experts in creating premium mobile solutions—like payment apps—that are customized to meet your specific requirements. Please get in touch with us if you would want to expand into this exciting market or improve your present products. Let’s work together to create the upcoming digital payment revolution.

Table of Content

What Is UPI and How Can Customers and Businesses Benefit From It?

What are the important features of Top UPI Payment Apps?

How to Create a UPI App like Phonepay, Paytm or Google Pay?

Speak with a UPI Mobile Application Development Firm

How Much Does It Cost to Develop an App for UPI Payments?